Agility and collaboration: building a low-latency, cloud-enabled, NextGen trade execution platform

Kepler Cheuvreux Execution Services (KCx) offers sophisticated execution capabilities to global investors. Its focus on agility, collaboration, and advanced quantitative capabilities has resulted in a modern brokerage that blends white-glove service with intelligent analytical execution algorithms.

Kepler Cheuvreux partnered with Adaptive to build its new NextGen trade execution platform – KCx Omni. The aim was to build a proprietary scalable sequencer-based architecture that could operate on-premises as well as in the cloud and allow KCx to continue to innovate at pace. The collaboration leverages the quantitative and technical capabilities of KCx together with Adaptive’s long standing track record of building low-latency trading platforms.

Brief:

- Build a scalable low-latency NextGen trade execution platform.

- Deliver a sequenced, event-based proprietary architecture.

- Build with the cloud in mind for future flexibility and scalability.

- Seamlessly integrate with the existing KCx technology stack.

Solution:

- Aeron®, the low-latency, high throughput, resilient messaging & clustering technology.

- Adaptive’s Hydra technology which streamlines the build process, enabling swift project delivery and ensuring the NextGen execution platform scales effectively over time.

- KCx’s internal development expertise combined with Adaptive’s capital markets technology experience.

Outcome:

- A proprietary sequencer-based technical architecture integrating all of KCx’s execution components.

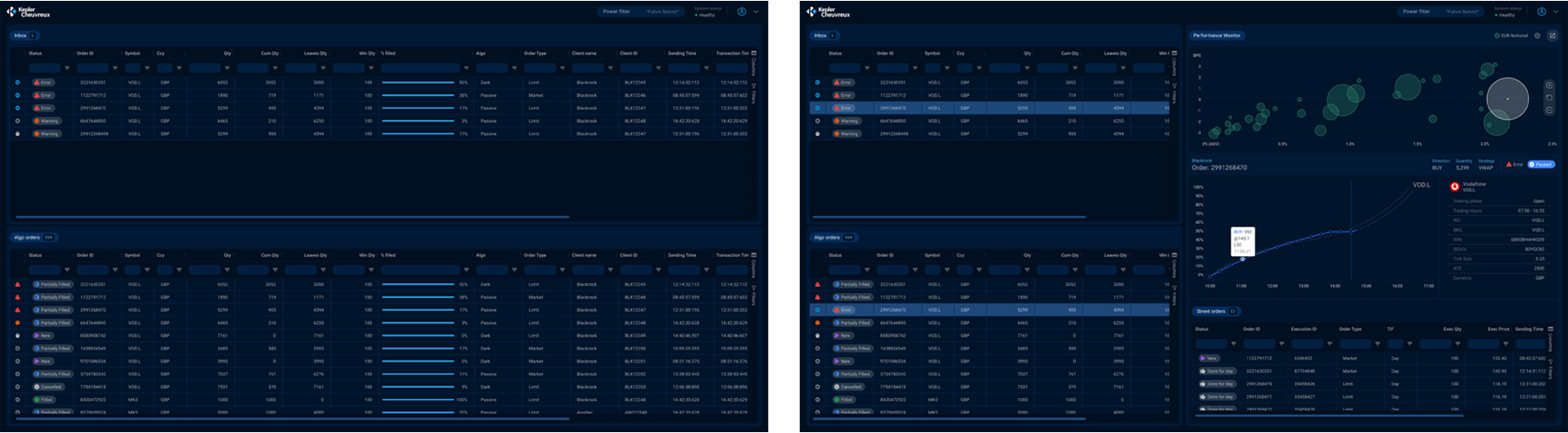

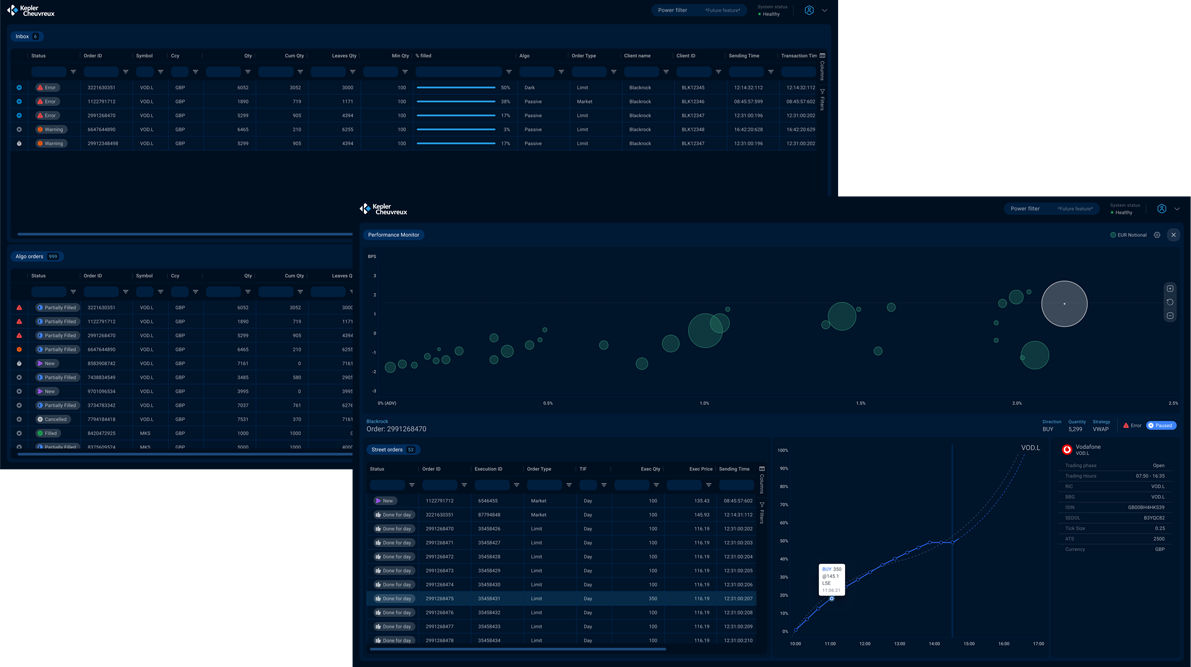

- A single, intuitive UI providing insight and analytics across all execution f lows.

- An automated functional and non-functional testing framework ensuring correctness and verifiable performance.

- A hybrid technology stack, able to leverage AWS Nitro Systems and kernel bypass to deliver reliable low latency performance on both cloud and on-premises.

Navigating the complexities of global equities trading

Global equities markets are more complex today than ever before, with market fragmentation, volatility, and increased regulatory scrutiny. Agility, client-centric focus, and advanced analytics are now table stakes for top tier firms. As a result, brokers are turning to advanced technology and event-driven algorithms to enable smarter trading and deliver the best possible execution experience. Technology- and data-driven innovation fuels the race for the next generation execution platforms and allows brokers to differentiate themselves and stand out from the competition.

“Working closely with Adaptive, we are realising our vision of a high-performance, resilient front office equities system that has the potential to scale and adapt as we meet the changing needs of institutions.”

The brief - Building a bespoke execution platform geared for agility and growth

Kepler Cheuvreux embarked on a transformative journey to reimagine what a modern trade execution platform could look like, incorporating open-source technologies and cloud computing into the very fabric of the platform. The ambitious initiative encompassed the full front-to back execution experience, looking at pre-trade, post-trade, data, and advanced analytical capabilities.

Partnering with Adaptive, KCx developed a bespoke open low-latency platform, seamlessly integrating with its existing technology and unifying its global equities ecosystem through a new sequencer based architecture. The new proprietary technology further extends KCx’s advanced quantitative capabilities, while additionally improving their agility and supporting their future ambitions.

Core components in a nutshell:

- Complement existing systems: Ensure that the new platform integrates with Kepler’s existing estate – unifying its capabilities and delivering new complementary features.

- Sequencer-based architecture: Implement a new underlying architecture to enable teams and systems to seamlessly access and interact with ordered streams of sequenced data, regardless of their unique development and release cycles.

- Design for scale: Develop an execution system that can facilitate increasing trading volumes and allows for further development across other asset classes.

- Increase resilience: In fast-paced markets, the reliability of brokers is essential. Resilience to potential outages or interruptions was a key project component.

- Simplify workflows: Replace the current myriad of point-to-point solutions with a single, integrated approach, accessible via an intuitive UI, for better visibility and transparency across the business.

- Build with the cloud in mind: Future proof the trading system by designing it to run on-premises and the cloud, on Amazon Web Services, Inc. (AWS).

- Unify global execution: Beyond streamlining the firm’s equities trading infrastructure, the new platform aims to harmonise the European and North American technology estates enabling seamless global execution.

“The architecture of Adaptive’s Hydra technology is ideally suited for the project and gives KCx strong foundations to develop new capabilities across asset classes, clients and trade types.”

The solution – Leveraging Adaptive’s technology platform

Key to the delivery of KCx’s new execution platform is Adaptive’s technical know-how, the Aeron and Hydra technologies as well as KCx’s deep domain expertise in trade execution. The platform is built around three core principles:

Sequencer architecture:

Aeron and Hydra’s clustered architecture is ideally suited to systems such as those underpinning the operations of Kepler Cheuvreux’s business. While Aeron provides low-latency, high-throughput and resilient messaging, Hydra, Adaptive’s proprietary development platform, accelerates the creation of complex real-time trading systems while ensuring ease of development, deployment, and operation. Together, they provided the building blocks required to develop a bespoke algo-driven execution platform, back-end functions and a new UI – enabling the delivery of the firm’s new architecture in just over 8 months. By removing architectural complexity, Hydra significantly de-risks development processes.

Hybrid development:

Kepler Cheuvreux’s new execution platform is being developed for on premise deployment but firmly with the cloud in mind. It leverages AWS infrastructure, allowing test, performance, and development environments to run in the cloud and giving Kepler Cheuvreux full f lexibility in where to run the platform.

Rapid deployment:

Adaptive’s expertise in building trading technology within a tight timeframe, coupled with the ability to deliver a cohesive front-end UI that unifies multiple applications into an easy-to-use interface, has enabled the project’s swift progress.

“This extensive project involves upgrades to nearly every aspect of our execution infrastructure... The fully sequenced system ensures a comprehensive record of events across all asset classes.”

The outcome

Kepler Cheuvreux is already running parts of the sequenced architecture with select production clients, giving them access to their new low-latency, resilient execution platform designed to initially support its equities business. The first phase was delivered in December 2023.

New capabilities include:

- Bespoke UI: An intuitive UI allows teams to monitor order flow and access vast swathes of data whilst creating a cohesive experience and consistent design across apps.

- Resilient architecture: The platform is fault tolerant and significantly reduces the risk of outages or interruption.

- Greater automation: Rationalising the firm’s global architecture has opened the door to greater automation. Increased compatibility and uniform functionality mean that KCx can automate workflows to generate efficiencies across the business.

- A platform for growth: The new execution platform enables Kepler to set its own parameters for growth and plan the development of new features and functionality across asset classes.